The pandemic and low interest rates fueled a big wave of cloud adoption, but that is all starting to dry up.

This is according to Bessemer Venture Partners (BVP) in their State of the Cloud 2023 report, which looks at cloud adoption through the lens of funding and market conditions.

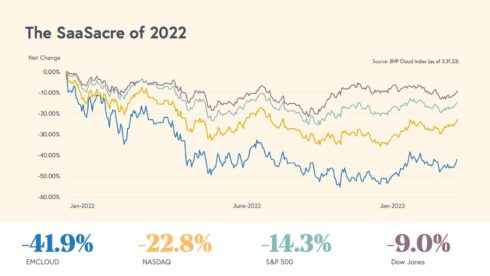

If you compare the cloud market to other market indices like NASDAQ, S&P 500, and Dow Jones, it declined disproportionately. The cloud market and the bull market in the U.S. economy peaked in November 2021 and has been steadily declining, though the cloud index showed a more significant decline than those other indices.

For example, the EMCLOUD index dropped by 41.9% from January 2022 to the end of March 2023, while NASDAQ only declined 22.8%.

Over the long-term and in general, however, cloud markets have consistently outperformed other market indices. “This is a testament to the power of the cloud model—one of the most attractive business models to ever be invented,” the company wrote in their report.

In the last 12 months the BVP Nasdaq Emerging Cloud Index growth rate was over twice the average S&P 500 company growth rate, according to the report.

The report also touched on the idea of “fundability” in cloud companies. BVP says that “the days of ‘easy money’ are over, and advised companies that there isn’t a perfect time to fundraise, so don’t wait for the next bubble to start trying to gather funding.

“We recommend not to try to time the market and instead fundraise when the capital is available to you. As we often say, the best time to fundraise is when you do not need the money,” the company wrote in a blog post.

BVP also focused on several fundability benchmarks that companies looking for investment should focus on. These include how much money you’re burning through, what your revenue is, and how quickly you are reinvesting back into growth.

Looking forward to the rest of 2023, the firm also spoke to 60 cloud investors to come up with some predictions. One prediction is that there will be a focus on the emerging sector of climate software.

A few areas that BVP is excited for at the moment include distributed energy resource infrastructure, project finance and energy developer software, and vertical software for solar, EVs, and heatpumps.

The other main focus area will be on AI. 96% of BVP investors plan to search for companies with AI-driven features to include on their investment roadmap.

“In January 2023, OpenAI’s ChatGPT, powered by GPT-3 and its successors, including GPT 3.5 and GPT-4, achieved a remarkable feat by amassing 100 million monthly active users just two months after launch. This historic moment makes ChatGPT the fastest-growing consumer application in history, highlighting the growing demand for AI-powered applications that can interact with users naturally and intuitively,” the company wrote in its report.

They predict that the value generated by AI will flow back to the end users. They say that the value of the efficiency gains created by AI will significantly exceed the market price of AI.

“As the ecosystem explodes, entirely new categories of products and services are emerging around AI capabilities. AI-native businesses are being built and designed from the ground up with AI at the core of the product offering. And we’re seeing new leaders rise in consumer and enterprise categories, as well as the emergence of a new layer of developer tools and enablers that make it easier to build and leverage AI,” the company wrote.